Zambia's President Hakainde Hichilema meets with IMF managing Director Kristalina Georgieva in Lusaka, Zambia January 23, 2023. IMF Photo/Kim Haughton/Handout via REUTERS

Bondholders’ NDA with government marks the beginning of formal $3bn debt restructuring talks of international bonds.

Lusaka, July 12 [Reuters] – Zambia’s overseas bondholders have entered into non-disclosure agreements (NDA) with the government as of Wednesday, according to three sources, a key step marking the beginning of formal talks to restructure over $3 billion of international bonds.

The government is expected to share with some of its biggest international bondholders – members of the creditor committee – detailed information that will form the basis of debt restructuring talks as early as Wednesday, said the sources with direct knowledge, who asked not to be identified because talks are private.

The move comes after Zambia, Africa’s second-biggest copper producer, clinched a deal with bilateral creditors such as China and the Paris Club to rework about $6.3 billion of debt in June, sending a signal that other pending national debt restructurings such as Ghana and Sri Lanka could also move forward.

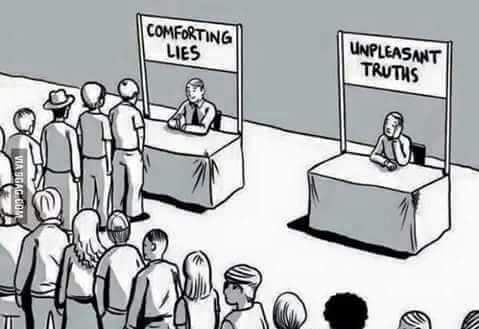

“We first need to see Zambia’s updated macroeconomic package, which is in part why we have to get restricted,” one of the sources said.

Also Read: Hichilema seals a $6.3 billion debt restructuring deal.

There will be a restriction period of two weeks, with the option to extend it if both sides agree, two sources added.

A spokesperson for the creditor group did not immediately comment. Zambia’s finance ministry did not immediately respond to a request for comment.

Zambia has three outstanding dollar bonds maturing in 2022 , 2024 and 2027 , trading at 52-57 cents on the dollar.

◾Getting Serious…

It is the first time bondholders have signed NDAs, which restrict them temporarily from trading the notes in exchange for non-public information, since Zambia’s 2020 default.

The creditor group, advised by Newstate Partners and Weil, Gotshal & Manges, consists of 15 European and U.S.-based institutions, holding in aggregate around 45% of Zambia’s Eurobonds.

Amia Capital, Amundi, BlueBay Asset Management, Farallon Capital Management, Greylock Capital and T. Rowe Price comprise the steering committee.

So far, initial discussion between private creditors and government officials have only been held between their financial and legal advisers.

Besides net present value reductions, talks will focus on how to incorporate the impact of a potential improvement of Zambia’s debt carrying capacity, or its ability to handle debt payments.

The deal with official creditors already includes a mechanism to accelerate loan repayments and raise interest if Zambia’s capacity changes from the current “weak” to “medium” following a joint International Monetary Fund and World Bank assessment in 2026.

Also Read: We don’t have a capable leader to mobilise national wealth.

“It would be a waste of time to get the debt restructuring without creating the necessary production capacity in the country to repay the debts when the repayments are due!”

Creditors are debating how to include so-called state-contingent debt instruments which would allow higher payouts based on improved economic outcomes, like gross domestic product, budget or export revenues, one source said.

“The indicator needs to be linked to the debt carrying capacity but that can’t be the direct trigger, because you would be handing a veto power to the IMF and the World Bank,” the source added.

The IMF and World Bank assessment looks at the real rate of economic growth, reserve import coverage and remittances, among other factors.

Creditors are discussing mechanisms that would revamp payments through higher coupons, shorter debt maturities or a combination of both, without modifying capital payments, one of the sources said.

The IMF executive board will meet on Thursday to complete the first review of the country’s $1.3 billion extended fund facility (EFF) programme. The country will have access to around $188 million after the review is completed.

You can follow Woodpecker’s Digest on Twitter and Facebook.

©2022 Woodpecker’s Digest Inc.

Putting news into perspective