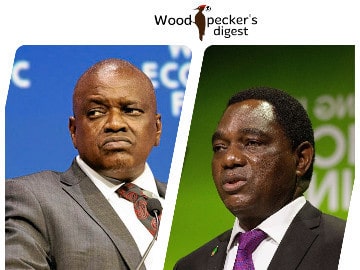

President Mokgweetsi Masisi wants a 50% stake in Debswana while President Hakainde Hichilema is happy to convert 20% shares in Kansanshi Copper and Gold Mine to a paltry 3.1% annual royalty payment.

Zambia, which gets crumbs from its cobalt, copper, gold, emeralds and other minerals while it begs the IMF for a $400m/year loan, has a lot to learn from Botswana. But it will take a new President! President Mokgweetsi Masisi wants a 50% stake in Debswana while President Hakainde Hichilema is happy to convert 20% shares in Kansanshi Copper and Gold Mine to a paltry 3.1% annual royalty payment.

Lusaka – Botswana may not renew a five-decade sales agreement with De Beers if the diamond producer doesn’t offer a larger share of rough diamonds to the state’s gem trading company, Okavango Diamond Company (ODC).

The move comes after the southern Africa nation acquired last month a 24% stake in Belgian diamond processing firm HB Antwerp for an undisclosed sum.

Analysts saw this deal as a way for Botswana to loosen the Anglo American owned miner’s grip on its diamond sector, which is a major source of employment and tax revenue for the country.

De Beers and Botswana jointly own Debswana, which mines almost all of the roughs gems in the country – the world’s second-largest diamond producing nation after Russia.

The partnership has helped Botswana become one of Africa’s fastest growing economies, while supplying De Beers 75% of Debswana’s rough diamonds, which are then sorted and sold to sightholders around the world.

Debswana’s diamond sales hit a record $4.6 billion in 2022, compared to $3.4 billion in 2021.

President Mokgweetsi Masisi has threatened to walk away from the talks if Botswana does not get a larger share of Debswana’s output for marketing outside the De Beers system.

The government has not publicly stated what share it seeks, but it is believed to be as high as 50%, double its current allocation.

The two parties have been negotiating for several years to extend their 2011 mining rights and sales agreement, which is due to expire in June this year.

◾”Colonial” model, a wake up call for Zambia.

Rafael Papismedov, co-founder of HB Antwerp, told the Financial Times that a revised deal would help Botswana break free from the current model of being “stuck in a box that says you can only dig and wash the diamonds.”

Papismedov added that De Beers’ operating model carries on “colonization” principles, acting as if Botswana was incapable of building midstream capabilities for polishing diamonds.

De Beers has said that the arrangement must make economic and strategic sense for both parties, adding that it is committed to supporting Botswana’s aspirations to grow its diamond industry.

But these negotiations have implications beyond the boundaries of Botswana.

Zambia’s economy is on its knees but the Hichilema led government decided to give tax cuts to foreign mining companies that already siphon at least $5bn a year through corruption and tax evasion practices from the copper and cobalt rich nation. It’s now pursuing a paltry $1.3bn IMF package over a period of three years.

Also Read: Zambia must abandon the IMF Programme – Amb. Mwamba.

President Hichilema’s decision to remove the country’s only source of income from its minerals, the Mineral Royalty Tax, rightly qualifies him to be called a puppet of these multinational mining firms. He is ready to see his people line up to buy the staple food, mealie meal while he rewards plunderers of the country’s natural resources merely for sponsoring his political campaigns.

Politics should not be a self preservation tool but a vehicle for development. He must use his position to change the life of an ordinary child in rural Zambia.

Unfortunately for Zambia, he is locked to what Rafael Papismedov, co-founder of HB Antwerp, terms the “colonisation” principle, accepting that Zambia is incapable of building midstream capabilities for managing the mining industry.

To imagine a small island, the United Kingdom, has a GDP of $3.066 trillion (2014) larger than the whole of Africa combined $2.7 trillion (2014), clearly points to leadership crisis on the continent.

Speaking at the African Leadership Forum (ALF) 2018 held in Kigali, President Paul Kagame called on African countries to address rising illicit financial flows, tax evasion and misallocation of Africa’s resources. He observed that by taking action, Africa would enable the continent to finance its own development.

“I would rather argue, that we need to mobilise the right mindsets, rather than more funding. After all, in Africa, we have everything we need, in real terms. Whatever is lacking, we have the means to acquire. And yet we remain mentally married to the idea that nothing can get moving, without external finance. We are even begging for things we already have. That is absolutely a failure of mindset,” the President said.

The United Nations Economic Commission for Africa (ECA) in May 2018 estimated that illicit financial flows for Africa stood at over $100 billion annually. Among the corrective measures to sustainably finance the continent’s development, Kagame said, included accountability, regional integration and fostering the growth of local enterprises.

Zambia is endowed with various precious natural resources ranging from emeralds and gold to mukula trees and wild life. It is imperative to acknowledge one basic principle in life: the decisions we make with the resources at our disposal, determine the life we end up living. Our leaders, additionally, ought to realise that most of these resources are finite and limited.

By definition, the allocation of them towards one’s personal political agenda limits the amount we have available towards others, especially those who need them most in the rural areas. We don’t want the UPND to fail because that entails our failure as a nation.

We do, however, have the right to remind our leaders that Zambia can only be developed by Zambians.

Remember to visit our website for more well researched articles, political analyses and commentaries.

©2022 Woodpecker’s Digest Inc.

Putting news into perspective